Yes, mold remediation can be covered by insurance, but only when the mold comes from a sudden and accidental event like a burst pipe. It is not covered when the mold forms from slow leaks, moisture problems, or neglect. This helps answer the question Is Mold Remediation Covered By Insurance with clear guidance.

This guide explains how insurance handles mold, when it pays for remediation, when it does not, and how a trusted mold remediation team like Colorado StainMaster can help keep your home safe and healthy.

Why Mold Becomes a Serious Problem in Homes

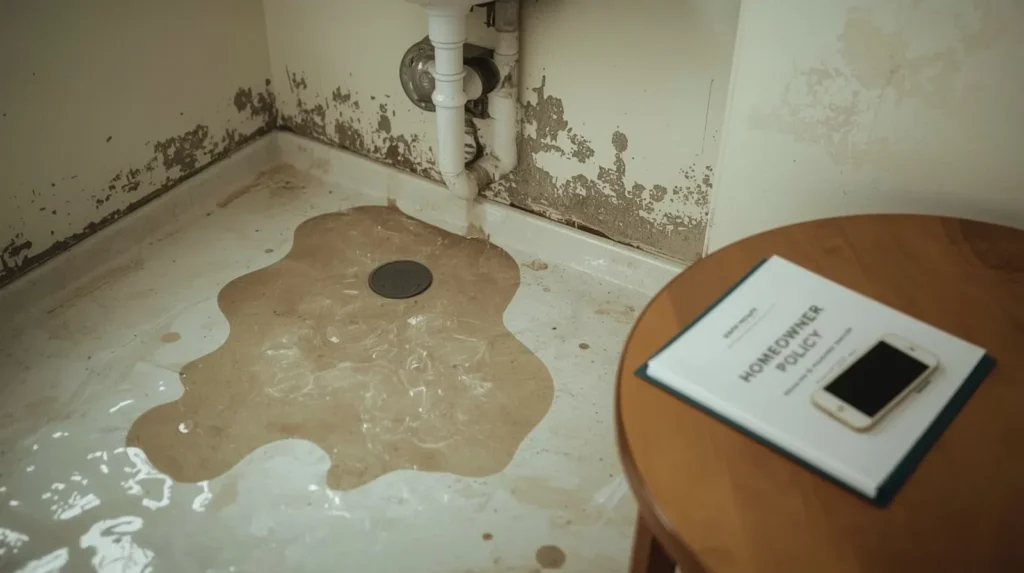

Mold does not take long to grow. When moisture stays in one place, mold spores settle, spread, and form small patches that grow bigger each day. Homes with bathrooms that stay damp, kitchens with hidden leaks, basements with humidity, or walls that trap moisture are more likely to have mold.

Many homeowners ignore early signs, thinking the spots will go away on their own. But mold grows in quiet places where you rarely look, like behind walls, under sinks, under carpets, in closets, and inside insulation. When it spreads, the damage can grow too. Mold can discolor paint, weaken drywall, soften wood, and create smells that make the home uncomfortable.

Parents often worry about mold because kids may be more sensitive to it. Anyone with breathing issues, like asthma, may also feel worse when mold is present. For this reason, knowing whether insurance will help gives homeowners peace of mind, especially when the damage seems large.

What Makes Professional Mold Remediation Important

Mold remediation is a detailed and careful process. It is more than wiping surfaces or spraying cleaners. Cleaning only removes what you can see. Remediation removes the mold you cannot see and stops it from returning.

A professional team uses tools that measure moisture, test the air, find hidden mold, and locate the real source of the problem. They seal off the area so mold spores do not spread. They use special filters to clean the air. They remove damaged materials safely. They also dry the space to prevent mold from growing again.

Store bought sprays and home methods often fail because they only treat the surface. Mold can sit deeper in walls or floors, and cleaning the outside does nothing to stop growth beneath. This is why professional help matters. It protects your home from more damage and reduces the chance of mold returning later.

A company like Colorado StainMaster follows step by step procedures that match industry standards. These methods keep families safe and ensure the problem is handled correctly the first time.

Is Mold Remediation Covered By Insurance in Most Cases

Your primary question matters to many homeowners: Is Mold Remediation Covered By Insurance? The answer depends on the cause of the mold. Insurance companies never look at the mold alone. They look at why the mold appeared.

If the mold comes from a sudden event that was impossible to predict, insurance is more likely to help. If the mold comes from slow problems that were not fixed early, most claims get denied. This rule applies in almost every policy.

Homeowners who file claims without understanding this rule often feel surprised when the claim is denied. That is why learning how mold coverage works saves time, stress, and money.

How Homeowners Insurance Typically Handles Mold Damage Claims

Insurance policies focus on sudden events rather than long term issues. Mold, by itself, is often seen as a result, not the main cause. That means insurance companies ask one question first. What caused the mold?

If a sudden water event created the mold, the insurance company may pay. If the mold formed slowly, the insurance company will see it as a maintenance issue. For example, mold caused by a burst pipe is treated differently than mold caused by a dripping pipe over six months.

Policies also have limits. Even when the mold is covered, many policies only pay a certain amount. Some plans offer extra mold coverage for homeowners who want more protection, but this is an optional add on. Many homeowners never buy it.

This is why reviewing your policy once a year helps you understand your coverage before you ever need to file a claim.

Will Homeowner Insurance Cover Mold After Sudden Water Damage

Sudden water damage is the number one reason insurance companies approve mold claims. This includes events such as:

A pipe bursts unexpectedly

A toilet overflows suddenly

A dishwasher hose snaps

A washing machine floods the laundry room

A storm breaks a window or roof opening and water enters the home

When these events occur, the homeowner usually has no control over what happened. Insurance is designed to help with sudden accidents, so mold that forms afterward may be covered.

However, action must happen fast. If the homeowner waits too long before cleaning the water or reporting the damage, the insurance company may argue that the mold grew because the homeowner failed to act. This can lead to a denial.

The key is fast action, fast reporting, and clear evidence.

When Mold Is Not Covered Under Homeowners Insurance

Insurance companies almost always refuse mold claims caused by slow or preventable issues. These are some examples:

A small leak under the sink that drips for months

A roof leak that has been ignored

Humidity problems in a basement that never gets aired out

A bathroom without an exhaust fan

Poor insulation that causes warm and cold air to meet and form moisture

Condensation around windows that never gets cleaned

Insurance companies treat these as problems the homeowner should have noticed early. If the damage grows because the problem was ignored, the claim is denied.

These denials do not mean the insurance company is being unfair. They follow written rules. Those rules protect the company from paying for issues caused by lack of maintenance.

Is Black Mold Covered Under Homeowners Insurance Policies

Black mold is often seen as more serious because of its possible health effects. Many homeowners believe insurance always covers black mold, but that is not the case.

Just like with other types of mold, insurance companies care about the cause, not the type. Black mold does not get special treatment. It is covered only when it appears after a sudden and accidental event.

If black mold forms because of long term moisture or poor ventilation, the claim will be denied. If it forms after a pipe burst or storm damage, the claim may be approved.

Color does not affect coverage. The cause always decides the outcome.

Key Factors That Affect Mold Remediation Coverage Approval

Insurance companies study several factors before approving a claim. These include:

Cause of the mold

Sudden events are more likely to get approved. Long term issues are not.

Homeowner response time

If the homeowner acted quickly, the insurer is more willing to approve. Waiting makes the insurer doubt the claim.

Documentation

Photos, videos, receipts for repairs, and inspection reports help prove your case.

Age of the damage

Fresh mold damage shows that the homeowner noticed the problem early. Old mold growth looks like neglect.

Policy limits

Even if approved, the policy may only pay a certain amount.

Exclusions

Many policies have specific mold exclusions.

Knowing these factors helps homeowners prepare before reporting the damage.

What Homeowners Should Do Before Filing a Mold Related Claim

Before making a claim, follow these steps so the process goes smoother:

- Find the water source

Look for leaks or water entry points. Knowing the cause matters most. - Record the damage

Take pictures and videos before touching anything. - Stop the water if possible

Turn off water lines, fix simple issues, or remove standing water. - Call a mold remediation professional for an inspection

An expert can confirm how far the mold has spread. - Review your policy

Look for mold coverage, limits, and water damage clauses. - Report the damage to the insurance company fast

The sooner you call, the better your chances.

These steps make the claim stronger and easier to process.

How Colorado StainMaster Handles Mold Remediation With Safe and Certified Methods in Colorado Springs

When mold appears in your home, safe removal is the priority. Skilled technicians use moisture readers, containment barriers, powerful filters, and industry approved cleaning methods that remove mold and prevent it from coming back.

The process includes finding the real cause of the moisture, drying the area, removing affected materials, and cleaning the space with safe procedures. Homes become cleaner, fresher, and healthier when mold is fully removed. Families feel safer, and the home stays protected from long term problems.

A trusted team follows strict safety steps from start to finish. Their work helps restore the home, protect your surfaces, and prevent future growth. This level of care reduces stress and makes the home feel solid and secure again.

When It Is Time to Call a Professional Mold Remediation Team

If mold keeps coming back, smells are getting stronger, or dark spots appear on walls, ceilings, or carpets, it is time to call a professional. Mold should never be ignored because it grows quickly and spreads far. Waiting only increases the damage and cost.

A trained team removes mold safely and knows how to prevent it from returning. Store cleaners only hide the problem, but trained experts remove the source. Professional help protects your home and keeps your family safe.

If you want a clean, safe, and healthy home again, reach out for mold remediation help today. Acting now prevents bigger problems later and keeps your home protected for the future.